The majority of today’s high net worth investors (HNWI) and ultra-high net worth investors (UHNWI) have grown up, or at least worked in, the digital age. As a result, digital age expectations now filter into all aspects of their lives, including their interactions with wealth managers.

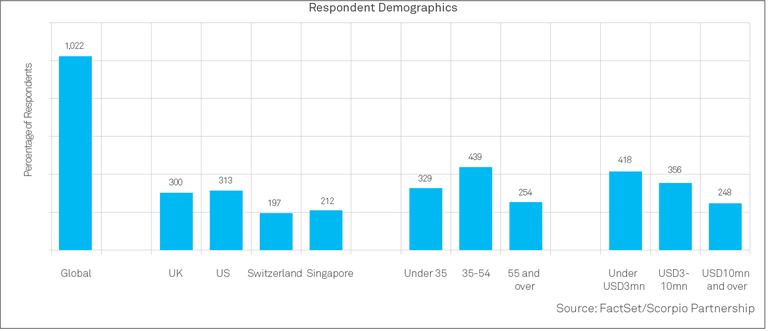

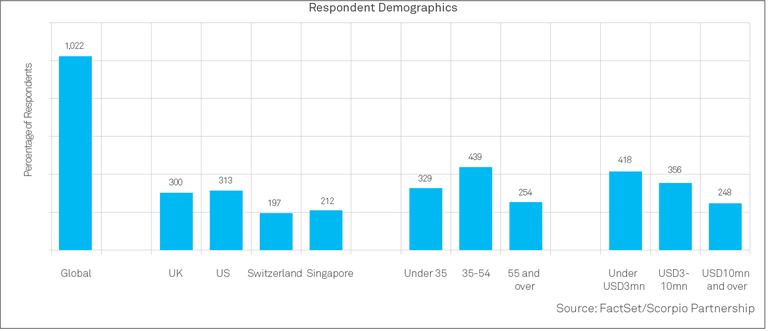

FactSet, together with Scorpio Partnership, surveyed over 1,000 HNWIs/UHNWIs across Singapore, Switzerland, the UK, and the US regarding their expectations of wealth management and how they envision their experience with their wealth manager evolving over time. The results uncovered clear calls to action for wealth managers around four key themes: information delivery, compliance, social responsibility, and innovation.

Related Webcast: What HNWIs Want: Technology and the Client Experience

In the context of these trends, it’s clear that wealth managers need to embrace the changing preferences of HNWIs.

1. HNWIs Expect More Frequent – and More Digital – Communication

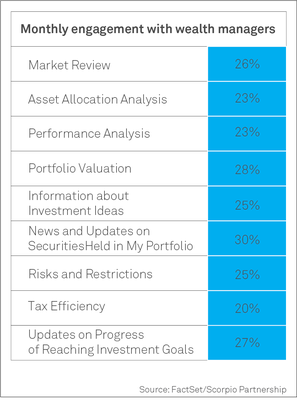

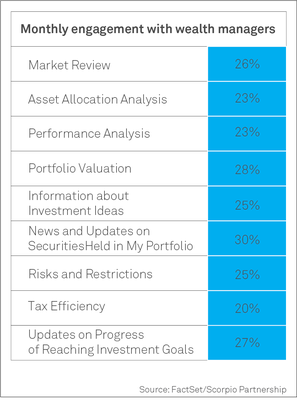

The first significant takeaway from the survey was that the HNW community is increasingly focused on the effective flow of information from their advisors and receiving key insights on their terms.

Only around 20% of HNWIs that responded want to receive information from their advisors face-to-face, and the preference for communication via digital forms, like email, social media, and mobile applications, is growing.

In addition to favoring digital delivery methods, HNWIs also want information more frequently than in the past — regardless of the level of data sensitivity.

When it comes to risk assessments, the majority of HNWIs would prefer wealth managers to report portfolio risk at least monthly. These expectations were even greater for the millennial generation (those under 35); nearly half of respondents in that group voiced a desire for weekly or daily assessments.

What this means in the long term is that wealth managers must prepare to serve their clients more proactively and offer more frequent communications on their clients’ wealth. The findings suggest it’s only a matter of time before clients are asking for real-time updates.

2. HNWIs Demand Risk Compliance

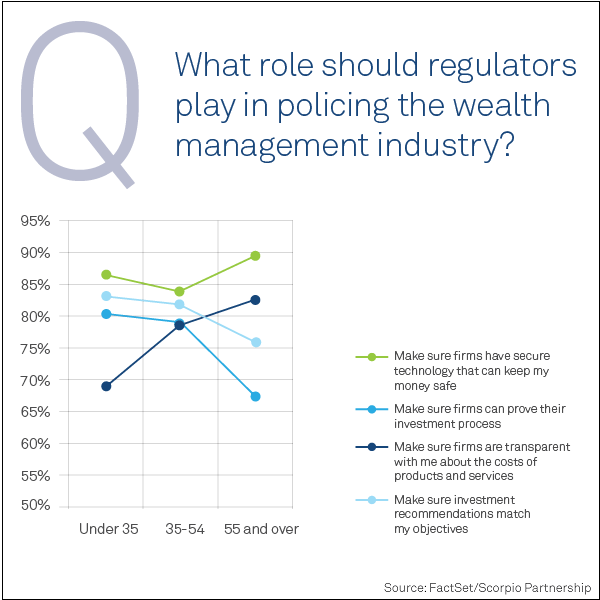

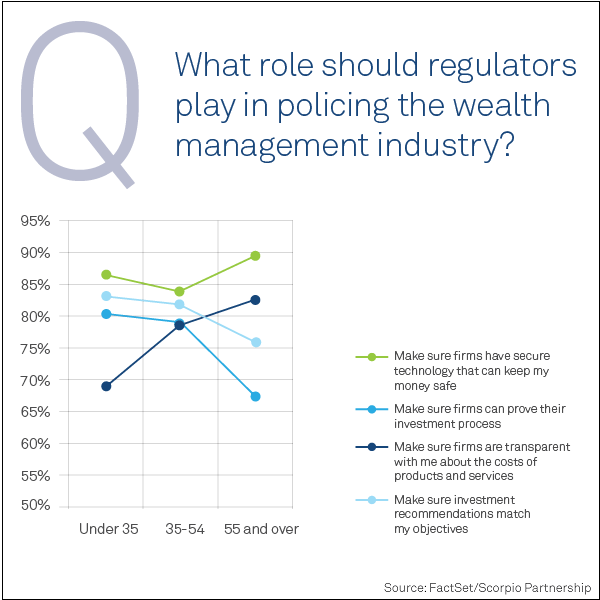

Another trend captured by the survey is a shift in attitudes regarding regulators. When asked about the role of regulatory agencies, 86% of HNWIs said regulator efforts should be directed toward minimizing risk for end clients by ensuring secure technology at wealth management firms.

Millennial HNWIs also believed industry watchdogs should police client outcomes and ensure that the investment processes of wealth managers are clearly documented.

3.HNWIs Seek Responsible, Honest Advisors

Responsibility is a prized brand attribute for wealth managers. In our survey, investors primarily define responsibility as honesty about the firm’s business practices and investment processes. Unsurprisingly, 82% of our global sample believes responsibility is a key quality of wealth managers. This belief is over 90% for the wealthiest individuals and US investors.

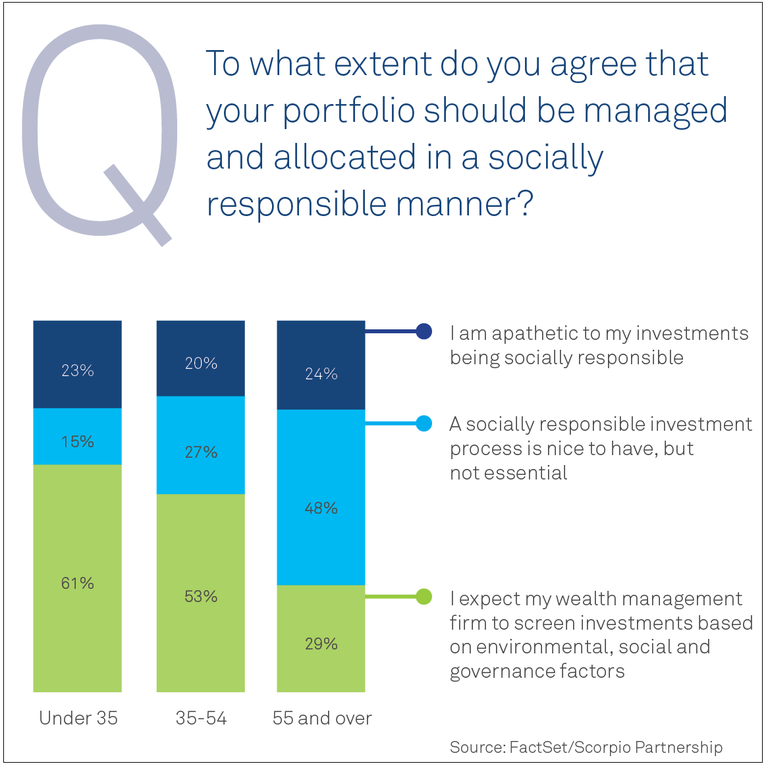

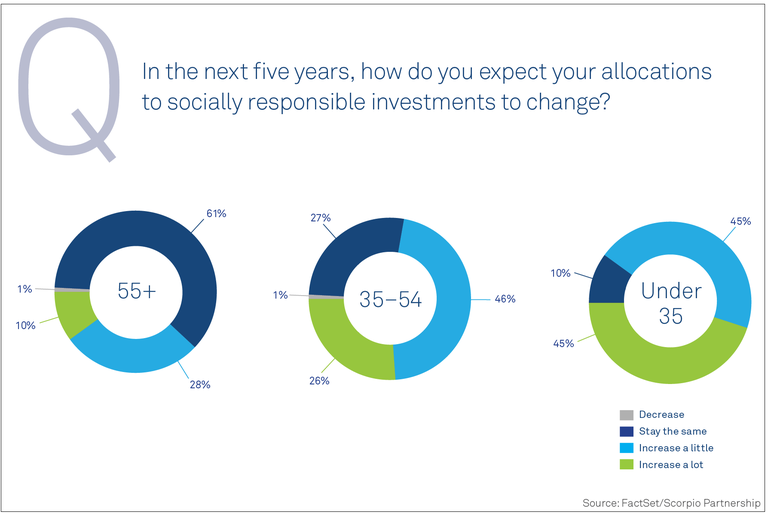

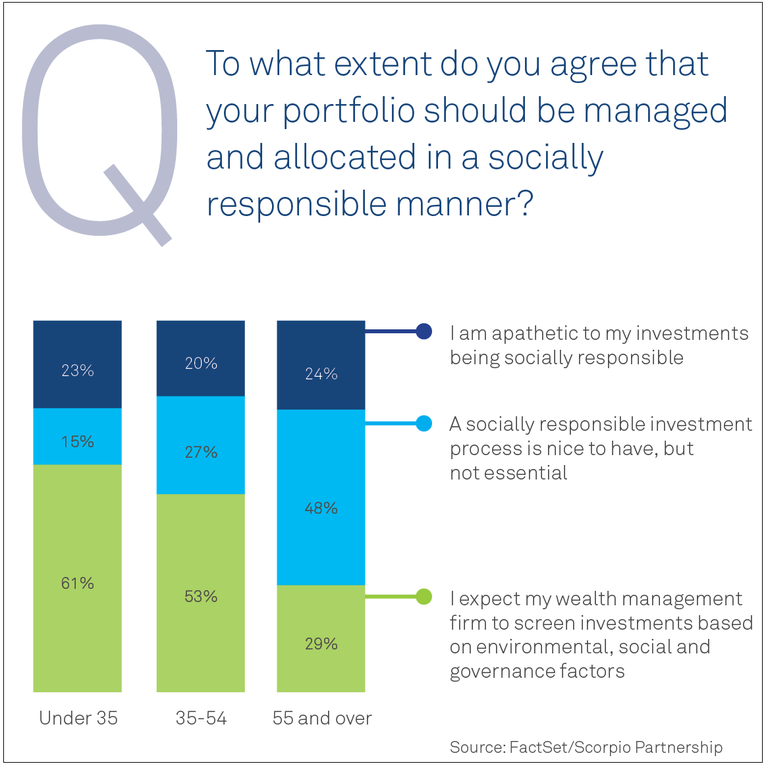

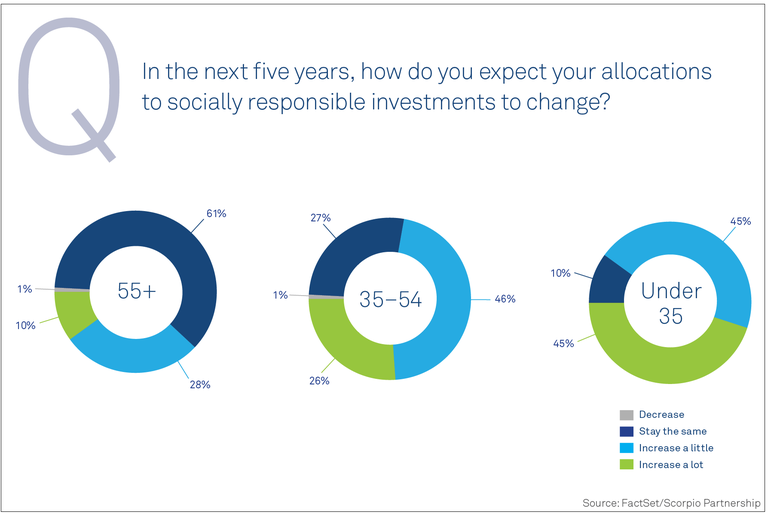

For HNW millennials, responsibility is also strongly associated with a socially responsible approach to investing. A third of respondents under 35 said they want evidence that their wealth managers are screening investments based on environmental, social, and governance (ESG) factors. This request was similar in the 35-54 age group, suggesting that a shift in investor expectations has already occurred.

For wealth managers, the conclusion is stark: Investors will demand more socially responsible investment processes as their portfolio allocations increase over time.

4.HNWIs Want Advisors Who Innovate

Another clear takeaway is that HNWIs want their advisors to embrace innovation as a means of distinguishing themselves against the competition. Sixty percent of respondents believe that their relationship with a wealth manager is enhanced by innovation.

Survey respondents also indicated that the ideal future wealth business model has two key characteristics: it must be focused on the effective delivery of predictive information, and it must intelligently apply user data.

What Changing HNWI Demands Mean for Wealth Managers

Communication, compliance, responsibility, and innovation underscore the shift that wealth managers are facing and provide a starting point for aligning strategies. But the survey also shows how younger HNWIs are influencing their older counterparts. The 35-54 year-old HNW community is behaving more inline with millennials than with baby boomers, and as a result wealth managers must assess their strategies to consider the preferences of a new generation of wealth.

The good news is that these findings form a clear call to action for wealth management firms, not stemming from the regulators or vendors, but from their clients.

Insight/Author%20Bios/Greg_King%202x3s.jpg)